Loading

Get 2004 Form 5329

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

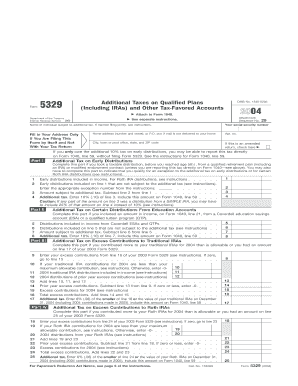

How to fill out the 2004 Form 5329 online

Filling out the 2004 Form 5329 can seem daunting, but with the right guidance, you can easily complete it online. This user-friendly guide will provide you with step-by-step instructions to ensure that your form is filled out accurately and efficiently.

Follow the steps to effectively complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the individual subject to additional tax in the designated field. If filing jointly, ensure both names are included.

- Provide your social security number and home address. This information is crucial for proper identification.

- Indicate if this is an amended return by checking the appropriate box if applicable.

- Complete Part I for additional tax on early distributions. Fill in the lines for early distributions included in income, any exclusions, and calculate the additional tax.

- Move to Part II to report any distributions from Coverdell education savings accounts or qualified tuition programs, including filling in the necessary lines.

- In Part III, report excess contributions to traditional IRAs. Follow the instructions carefully to identify and calculate excess contributions.

- Proceed to Part IV, which covers excess contributions to Roth IRAs. Ensure all calculations are made accurately.

- In Part V, address any excess contributions to Coverdell ESAs. Enter the required figures according to the instructions.

- Continue to Part VI to complete the section on Archer MSAs, filling in all relevant data.

- Finally, complete Part VII regarding Health Savings Accounts and Part VIII for any excess accumulation requirements.

- Once all parts are filled out and verified, save changes, download, print, or share the completed form as needed.

Start filling out your 2004 Form 5329 online today!

To locate 2004 Form 5329 on TurboTax, start by navigating through the 'Forms' section. You can search for the form directly in the search bar, or find it under the 'Retirement' part of the tax return process. TurboTax will guide you through any necessary questions, making it easier to fill out this form accurately. If you encounter difficulties, the help sections within TurboTax provide valuable tips for smooth navigation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.