Loading

Get 2004 Form 3520

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 Form 3520 online

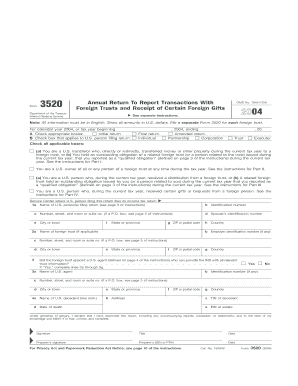

Filing the 2004 Form 3520 online is a crucial step for U.S. persons who have engaged in transactions with foreign trusts or received certain foreign gifts. This comprehensive guide will walk you through each section of the form, ensuring a clear understanding of the requirements.

Follow the steps to complete your Form 3520 accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your browser for editing.

- Begin by completing the identification section, which includes your name, identification number, address, and any applicable details about your spouse if it's a joint return. Ensure that all information is accurate and clearly presented.

- In Part I, check the appropriate boxes to indicate the nature of your filing (initial, amended, or final return) and the type of U.S. person filing (individual, partnership, corporation, etc.). Make sure to specify if you're a U.S. transferor or owner of a foreign trust.

- Complete the questions related to transactions made during the year with foreign trusts, such as whether funds or properties were transferred or received.

- If applicable, in Schedule A, provide details about any obligations received as part of a related foreign trust and indicate if those obligations were qualified as per IRS criteria.

- In Schedule B, report any gratuitous transfers made to a foreign trust, detailing the descriptions, values, and any documentation attached.

- Complete Schedule C which relates to any outstanding obligations related to foreign trusts, answering the relevant questions about the qualifying conditions.

- For Part IV, disclose any gifts or bequests received from foreign persons, ensuring to report values correctly. Attach any additional documentation if necessary.

- Review all sections for completeness and accuracy, ensuring that any necessary attachments are included. Sign and date the form, verifying that all information provided is correct to the best of your knowledge.

- Once completed, save your changes, then download, print, or share your form as required, following any specific submission guidelines.

Complete your 2004 Form 3520 online today to ensure compliance and accurate reporting of your foreign transactions.

Yes, you can file the 2004 Form 3520 electronically if you use specific approved software or platforms. However, ensure that you follow all regulations to avoid complications. Platforms like USLegalForms may offer electronic filing options that make this process smoother and more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.