Get Irs Form 2031

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 2031 online

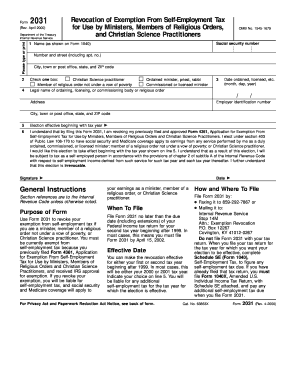

Filing the Irs Form 2031 is an essential step for individuals looking to revoke their exemption from self-employment tax. This guide will provide a clear, step-by-step approach to filling out the form online, ensuring that you understand each requirement and can complete it with confidence.

Follow the steps to fill out the Irs Form 2031 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In the first field, enter your name exactly as it appears on your Form 1040 to ensure accurate identification.

- Select one box that identifies your role—options include Christian Science practitioner, ordained minister, priest, rabbi, or member of a religious order not under a vow of poverty.

- Provide your address, including the number and street, city, town or post office, state, and ZIP code.

- Fill in your employer identification number (EIN) in the provided field.

- Indicate the date you were ordained, commissioned, or licensed using the format month, day, year.

- On line 5, state the effective tax year for your revocation, either your first or second tax year beginning after 1999.

- Read and acknowledge the statement on line 6, signing and dating the form to confirm your understanding that this election is irrevocable.

- Once all fields are filled, you can save changes, download, print, or share the completed form as needed.

Complete your Irs Form 2031 online today to ensure proper handling of your tax status.

The minimum self-employed earning without paying tax varies depending on the individual's overall income, deductions, and tax credits. However, for self-employed individuals, if your net earnings are less than $400, you typically do not owe self-employment tax. Understanding the implications of various forms, including IRS Form 2031, can enhance your tax strategy and compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.