Loading

Get Form 2004 Schedule K 1 2011s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2004 Schedule K 1 2011s online

Filling out the Form 2004 Schedule K 1 2011s online can be a straightforward process with proper guidance. This guide will walk you through each section of the form, ensuring you understand the necessary information to complete it accurately.

Follow the steps to complete your form successfully.

- Click the 'Get Form' button to retrieve the form and open it in your preferred editing tool.

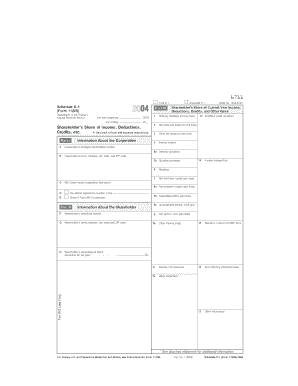

- Begin by entering the corporation's information in Part I. This includes the corporation's employer identification number (EIN), name, and address. Ensure all details are accurate and match the corporation’s records.

- Proceed to fill out the shareholder’s information in Part II. Provide the shareholder’s identifying number, name, and address, along with their percentage of stock ownership for the tax year.

- Move on to Part III, where you will detail the current year’s income, deductions, credits, and other items. Carefully input all relevant financial figures, including ordinary business income, rental income, and any other applicable items as instructed.

- Review all the information entered for accuracy. Ensure that every section reflects the accurate figures and details required for filing.

- Once you have completed the form, you can save your changes, download the filled form, print it out, or share it as needed.

Start completing your Form 2004 Schedule K 1 2011s online today!

While it is technically possible to file your taxes without your K-1, it is not advisable. If you do not report the income from the K-1, you may face penalties or audits later on. It's best to wait for your Form 2004 Schedule K 1 2011s to ensure everything is accurately reported, or consult with USLegalForms for strategies on managing delays in receiving necessary tax documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.