Get 1545-0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

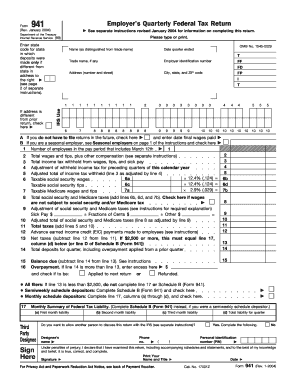

How to fill out the 1545-0029 Enter State Code for State in Which Deposits Were Made Only If Different From State In online

Filling out the 1545-0029 form accurately is crucial for compliance with federal regulations. This guide provides a clear, step-by-step approach to help users understand how to complete the form online, ensuring that all necessary information is included correctly.

Follow the steps to effectively complete the 1545-0029 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the state code for the state in which deposits were made only if this state differs from the one shown on your address. This is typically entered in a designated box on the form.

- Next, specify the date quarter ended. Ensure that the date format complies with the requirements outlined in the document.

- Provide the trade name of your business, if applicable. This should reflect the name under which you conduct business, distinct from your legal entity name.

- Input your employer identification number (EIN) in the specified field. This number is essential for IRS identification purposes.

- Fill in your complete address, including number and street, city, state, and ZIP code. Make sure these details match the IRS records exactly.

- Indicate the number of employees during the pay period that includes March 12th. This information is vital for tax calculations.

- Complete the necessary sections related to wages, tips, and any taxes withheld. Carefully follow the specific instructions provided in the separate instructions document.

- Once all sections are filled out, review the information to ensure accuracy. Check that the totals match the calculations provided.

- Save changes to the form. You may also choose to download or print the completed document for your records.

Start filling out your 1545-0029 form online today to ensure timely and accurate submission!

To fill out a 941 Schedule B form, you need to provide information related to your tax liability, including the total amount of taxes collected for each month in the current quarter. It is important to double-check your calculations against payroll data for accuracy. Accurate completion of this form helps avoid discrepancies with IRS filings tied to the 1545-0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In. Resources like uslegalforms offer step-by-step guidance to simplify this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.