Loading

Get 940 Form 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 940 Form 2004 online

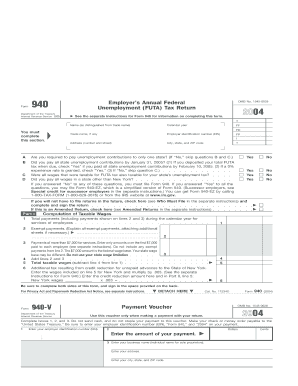

Filling out the 940 Form 2004 online is essential for employers reporting their annual Federal Unemployment Tax Act (FUTA) contributions. This guide will provide clear steps to assist you in completing the form accurately.

Follow the steps to complete the 940 Form 2004 online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your name and trade name, if applicable, in the corresponding fields on the form.

- Provide your Employer Identification Number (EIN) and address, including city, state, and ZIP code.

- Indicate the calendar year for which you are filing the form.

- Answer the questions related to state unemployment contributions. If required, check ‘Yes’ or ‘No’ and fill out the subsequent questions accordingly.

- In Part I, report your total payments to employees for the calendar year under line 1 and any exempt payments in line 2.

- Calculate amounts over $7,000 paid to each employee and enter in line 5. Ensure the total taxable wages are accurately subtracted from previous lines.

- Complete Part II by calculating your gross FUTA tax and any applicable credits. Provide details in the sections asking for state contributions.

- Sign the form declaring its accuracy and completeness, and indicate the title of your position.

- After completing the form, review your entries, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online effortlessly to meet your filing obligations.

Failing to file the 940 form can lead to penalties and interest on unpaid taxes. The IRS may also take further action, including assessments of additional taxes and fees. To avoid these consequences, it's advisable to file the 940 Form 2004 accurately and on time. Utilizing platforms like uslegalforms can simplify this process and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.