Loading

Get 1281 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1281 Form online

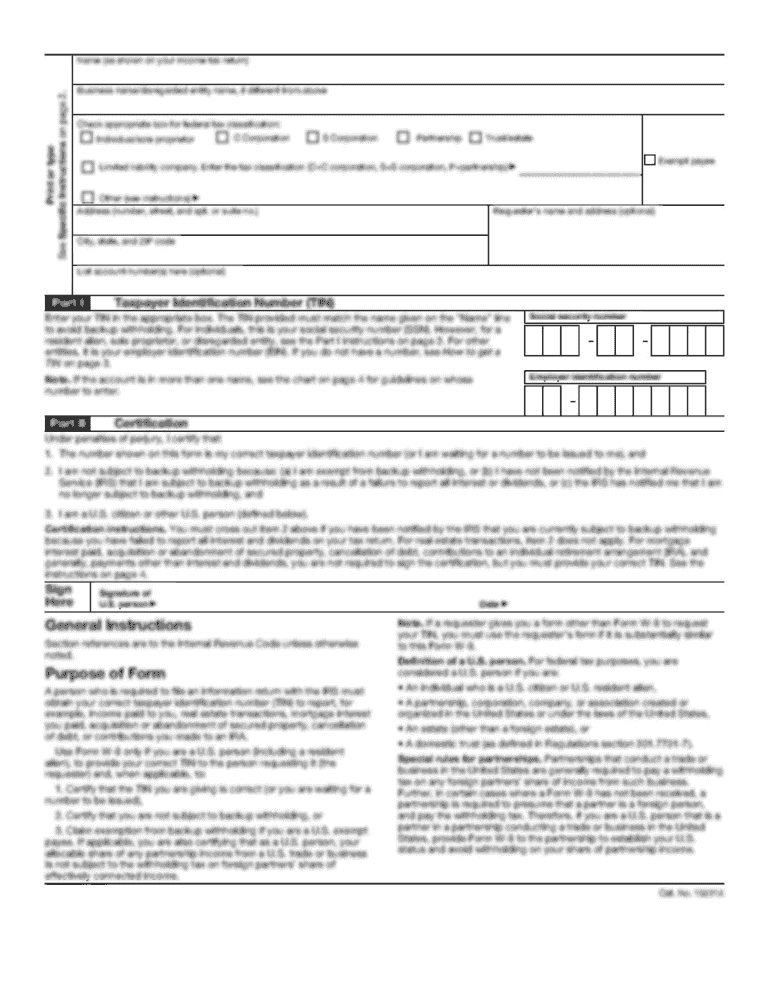

The 1281 Form is essential for taxpayers who need to address backup withholding for missing or incorrect taxpayer identification numbers (TINs). This guide will walk you through each section of the form, ensuring a clear understanding of how to complete it efficiently online.

Follow the steps to fill out the 1281 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the correct taxpayer identification information, ensuring that your name matches the provided TIN. This is vital for preventing penalties.

- Complete the relevant sections regarding backup withholding, detailing the nature of the payments and identifying the missing or incorrect TIN.

- When requested, provide supporting information or documentation to clarify any discrepancies related to TINs.

- Review all entries for accuracy. Ensure that the information is complete and correctly formatted to avoid delays in processing.

- Once you have filled out the form, you can save changes, download, print, or share the form as needed.

Complete and file your documents online to ensure compliance and accuracy.

The Australian value statement outlines the fundamental principles that Australian citizens agree to uphold, including respect for laws and regulations. It emphasizes the importance of contributing to the community and embracing diversity. Familiarizing yourself with this statement before filling out the 1281 Form will strengthen your application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.