Get 9465sp Electronic Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 9465sp Electronic Form online

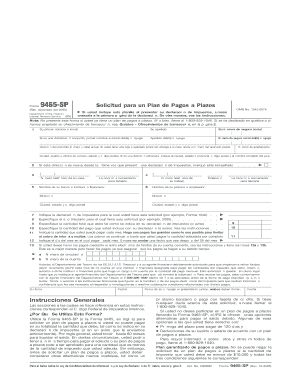

This guide provides comprehensive instructions for users to effectively complete the 9465sp electronic form. Whether you are familiar with digital forms or new to this process, the following steps will make it easier to submit your application for a payment plan.

Follow the steps to successfully complete the 9465sp electronic form.

- Press the ‘Get Form’ button to acquire the electronic version of the form and open it in your designated online environment.

- Begin by entering your first name and initial in the appropriate fields. If you are filing jointly, include your partner’s first name and initial as well.

- In the next fields, provide your last name and your partner's last name if applicable, along with your social security numbers.

- Fill in your current residential address, including any relevant apartment details, city, state, and zip code.

- Indicate your home phone number and a convenient time for a call. Additionally, provide your work phone number.

- Record the name of your financial institution and your employer, along with their addresses.

- Specify the tax return you are applying this request for (e.g., Form 1040).

- Indicate the tax year related to your request.

- Enter the total amount owed as stated in your tax return or notice.

- Document any payment you are submitting with this form.

- State the monthly payment amount you can afford.

- Indicate your preferred payment date each month, ensuring this does not exceed the 28th.

- If choosing electronic funds withdrawal, fill in your bank routing number and account number.

- Review all entries to ensure accuracy before signing the form.

- After completing the form, save your changes, and then download, print, or share the form as needed.

Complete your 9465sp electronic form online today to get started with your payment plan.

The IRS does not accept some forms electronically, including certain business tax forms and specific situations requiring paper documentation. It is essential to check the latest IRS guidelines for the most current updates regarding electronic filings. However, many taxpayers find that forms like the 9465sp Electronic Form streamline their experience. To get personalized assistance and ensure proper submission, explore resources on US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.