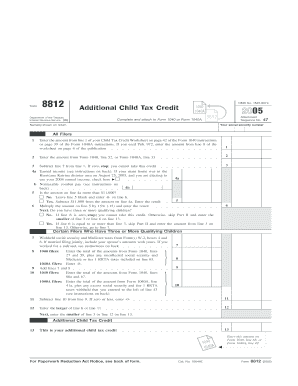

Get Irs 2005 Form 8812

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs 2005 Form 8812 online

Filling out the Irs 2005 Form 8812 online can help you determine your eligibility for the additional child tax credit. This guide will provide you with step-by-step instructions on how to complete the form accurately and efficiently, ensuring that you maximize your potential benefits.

Follow the steps to complete the Irs 2005 Form 8812 online:

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In the first section, enter the names as shown on your tax return in the designated field.

- Provide your social security number in the appropriate box.

- Complete line 1 by entering the amount from line 1 of your Child Tax Credit Worksheet.

- Next, provide the amount from Form 1040, line 52, or Form 1040A, line 33 in line 2.

- Subtract line 2 from line 1 and record the result on line 3. If the result is zero, stop as you cannot take this credit.

- For line 4a, indicate your earned income. If applicable, check the box if you wish to use your 2004 earned income due to Hurricane Katrina.

- In line 5, determine if the amount on line 4a is more than $11,000. Depending on your answer, follow the appropriate instructions regarding lines 6 and 13.

- Complete Part II if applicable, especially for filers with three or more qualifying children, and enter the total amounts as instructed.

- Finally, review your entries for accuracy, and save your changes. You can download, print, or share the completed form directly from your editor.

Complete your Irs 2005 Form 8812 online today to ensure you receive your full entitled benefits.

To attach forms like the IRS 2005 Form 8812 to your tax return, you should follow the instructions provided by the IRS or your tax software. Typically, you'll place the form behind your main tax form, ensuring all necessary documents are included. Platforms like US Legal Forms offer guidance on the best practices for attaching forms to ensure your submission is complete.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.