Loading

Get Irs Forms 5329 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Forms 5329 2005 online

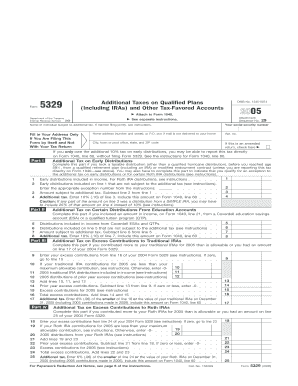

Filling out the Irs Forms 5329 from 2005 online can be a straightforward process if you follow the right steps. This guide will provide you with clear instructions on how to effectively complete the form to report additional taxes on qualified plans and tax-favored accounts.

Follow the steps to fill out the Irs Forms 5329 2005 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Fill in your personal information including your name, address, and social security number. Ensure this information is accurate to prevent delays in processing.

- Indicate if you are filing the form by itself or as an attachment to Form 1040. If you are filing by itself, fill in your address as required.

- Complete Part I for additional tax on early distributions. Fill in the lines relating to early distributions included in income, exceptions, and calculate the amount subject to additional tax.

- Proceed to Part II and complete it if you had distributions from education accounts. Follow the instructions for lines regarding distributions and calculate any additional tax.

- In Part III, you will address any excess contributions to traditional IRAs for the year 2005. Accurately report any excess amounts and the subsequent tax obligations.

- Complete Part IV for excess contributions to Roth IRAs with the necessary information and calculations noted in the prior steps.

- Follow through Parts V, VI, VII, and VIII, filling in the respective sections for Coverdell ESAs, Archer MSAs, HSAs, and excess accumulations ensuring to report any excess contributions and additional taxes.

- After filling out all necessary sections, review the form for completeness and accuracy to ensure information is correct before submission.

- You can then either save your changes, download a copy of the filled form, print it, or share it as needed.

Start filling out your Irs Forms 5329 2005 online today to ensure timely and accurate tax reporting.

To locate your tax return form, you typically refer to copies stored in your records for IRS Forms 5329 2005 if you have filed them. If you used tax software, you can easily access previous returns through your account. Additionally, the IRS website allows you to request a transcript of your tax return for your records. Keep these documents organized for future reference.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.