Loading

Get 2005 Form 1120s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Form 1120s online

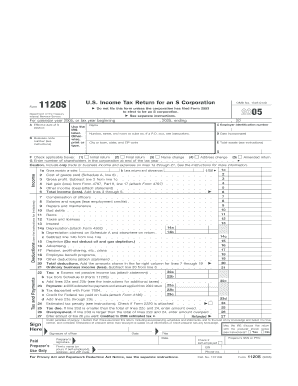

The 2005 Form 1120S is the U.S. Income Tax Return for an S Corporation. This guide will walk you through the steps necessary to complete the form online, ensuring that you meet all requirements and accurately report your corporation's income and deductions.

Follow the steps to successfully complete the online form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the corporation in the designated fields. Ensure that you provide the correct employer identification number (EIN).

- Indicate the date of incorporation and the effective date of S election by filling in the appropriate spaces.

- In section B, provide the business code number by referring to the IRS instructions.

- Fill out the financial information, including total assets and the number of shareholders by the end of the tax year.

- Complete the income section by specifying gross receipts, cost of goods sold, and total income.

- Proceed to the deductions section, itemizing expenses such as salaries, repairs, and taxes. Make sure to total all deductions accurately.

- Calculate the tax and payments, ensuring that you include all necessary taxes and any estimated tax payments made.

- Sign the form electronically, confirming that you have reviewed and validated the information provided.

- Once all sections are completed, save your changes, and choose to download, print, or share the form as needed.

Start filling out your 2005 Form 1120S online today!

Related links form

To get your S Corporation, you'll first need to incorporate your business by filing the appropriate formation documents with your state. Once this is done, you can submit Form 2553 to the IRS to elect S Corporation status. If you seek assistance in navigating this process, online platforms like US Legal Forms provide resources to help you successfully establish your S Corp status and ensure you file the 2005 Form 1120S timely.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.