Loading

Get 2005 Schedule Se Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Schedule Se Form online

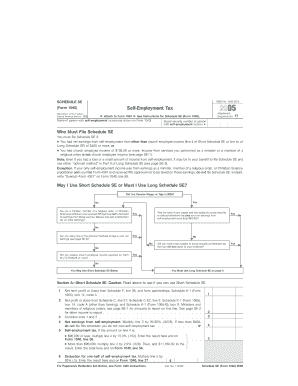

Filling out the 2005 Schedule SE Form online is an essential step for individuals with self-employment income to calculate their self-employment tax accurately. This guide provides clear, step-by-step instructions to help users navigate the form with confidence and ease.

Follow the steps to complete the Schedule SE Form online.

- Press the ‘Get Form’ button to download the Schedule SE Form and open it in the designated online editor.

- Begin by entering your name as it appears on Form 1040 in the designated field for the name of the person with self-employment income.

- Next, input your social security number in the provided field, ensuring accuracy for proper identification.

- Determine if you must file Schedule SE by reviewing the criteria that require a filing, such as having net earnings from self-employment of $400 or more.

- If eligible, proceed to Section A for the Short Schedule SE or Section B for the Long Schedule SE based on your specific income details and requirements.

- Fill in the required financial information in the relevant sections, including net farm profit or loss, and net profit or loss from other sources, by following the prompts in the form.

- Calculate your self-employment tax according to the instructions provided for lines 5 and 6, following the outlined percentages based on your reported earnings.

- Review your entries to ensure all calculations are correct and complete before finalizing your form.

- Once satisfied with your entries, save your changes, and utilize the options to download, print, or share the completed Schedule SE Form.

Start filling out your Schedule SE Form online today to ensure accurate tax reporting!

Yes, failing to file the 2005 Schedule SE Form when required can result in penalties and interest on overdue taxes. Not only does this create potential financial liabilities, but it can also impact your eligibility for Social Security benefits. It is advisable to file on time to avoid consequences.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.