Loading

Get 2005 Schedule C Ez Online Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Schedule C Ez Online Form online

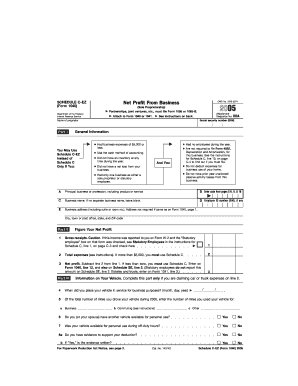

The 2005 Schedule C Ez online form is a simplified tax form designed for sole proprietors to report their business income and expenses. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete your Schedule C Ez online form.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter your name and social security number in the respective fields. Ensure that the name matches the one on your tax return.

- In Part I, provide a description of your principal business or profession in Line A. Include the type of product or service you offer.

- In Line B, enter the six-digit code that identifies your business activity, which can be found in the instructions.

- Complete Line D if applicable. If you have an employer identification number, enter it here; otherwise, leave it blank.

- Fill in Line E with your business address. If your business address is the same as what you provided on Form 1040, you can skip this line.

- In Part II, report your gross receipts on Line 1. Ensure to include all taxable income received during the year.

- Enter the total deductible business expenses on Line 2. If your expenses exceed $5,000, you will need to use Schedule C instead.

- Calculate your net profit on Line 3 by subtracting Line 2 from Line 1, and make sure to follow the instructions if this amount is negative.

- If applicable, complete Part III to report vehicle expenses. Fill in the dates, mileage, and confirm if you have another vehicle available for personal use.

- Review all entries for accuracy, then proceed to save your changes. You can also download, print, or share the completed form as needed.

Complete your 2005 Schedule C Ez online form today for efficient tax filing.

You can get a Schedule C form directly from the IRS website, where you will find printable and fillable versions available. Additionally, various online tax services provide easy access to the form, including the 2005 Schedule C Ez Online Form, which simplifies the filing process for taxpayers. These resources offer convenient access to ensure you meet your reporting needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.