Loading

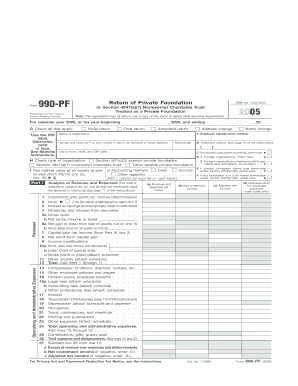

Get Form 990-pf - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 990-PF - Internal Revenue Service online

Filling out Form 990-PF can be a critical process for private foundations to report their financial activities. This guide provides a comprehensive and user-friendly approach to completing the form online, ensuring you have the information you need to accurately complete each section.

Follow the steps to effectively complete your Form 990-PF.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter the name of the organization in the designated field, ensuring it matches the records on file with the IRS. Provide the organization's Employer Identification Number (EIN) for identification.

- Select the applicable return type by checking the corresponding box for 'Initial return,' 'Final return,' or 'Amended return.'

- Fill in contact information, including the address and telephone number, ensuring accuracy to facilitate communication with the IRS.

- Complete Part I, detailing the fair market value of all assets at the end of the year, aligning with your financial records.

- Move to the revenue and expenses section, recording all amounts accurately while ensuring totals tally as per your records.

- Navigate to Part II to list balance sheet information, ensuring you differentiate between book value and fair market value where required.

- Proceed to analyze changes in net assets, providing clarity on increases or decreases and documentation of transactions.

- Complete the capital gains and losses section, detailing all sales of assets, including dates and sales amounts.

- Thoroughly review the miscellaneous statements, ensuring all related activities of the foundation are documented and compliant.

- After filling out all necessary fields, save your changes, and utilize options to download, print, or share the completed Form 990-PF.

Encourage others to complete their forms online for a smooth and efficient filing process.

Several forms, including certain paper-based tax forms, cannot be filed electronically due to IRS regulations. Forms that require original signatures or have specific filing requirements are often not eligible for electronic submission. Always check the IRS guidelines to determine which forms can be filed electronically, including considerations for Form 990-PF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.