Loading

Get Form Ct 706709 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ct 706709 2005 online

This guide provides comprehensive instructions on completing the Form Ct 706709 2005 electronically. By following these steps, you can ensure accurate submission of your gift tax return, minimizing potential errors and delays.

Follow the steps to complete the form easily and accurately.

- Use the ‘Get Form’ button to access the form and launch it in your browser or editing tool.

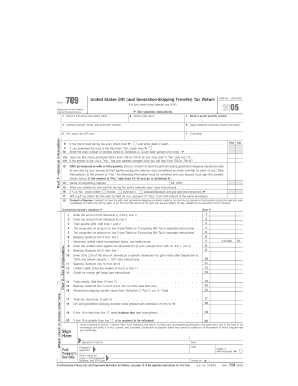

- Begin with Part 1—General Information. Enter the donor's first and last name, social security number, legal residence, and citizenship status. If the donor has passed away during the year, indicate this by marking the appropriate box.

- Proceed to confirm whether the donor has previously filed a Form 709. If applicable, respond to questions about any address changes. This information is crucial for IRS records.

- If gifts were made by a spouse to third parties, answer the consent question and provide the spouse's name and social security number, as well as whether you were married the entire calendar year.

- In Part 2—Tax Computation, calculate the total taxable gifts by adding the relevant amounts from Schedule A, ensuring that you fill out lines accurately.

- Complete Schedule A by listing all gifts made, including details such as the donee’s name, relationship to the donor, type of gift, and its value. Make sure to calculate any necessary deductions.

- In Schedule B, if applicable, report gifts from prior periods, ensuring to follow instructions carefully to maintain accuracy.

- Finally, review all entries for accuracy. Save your changes, and then you can opt to download, print, or share the completed form directly from your device.

Complete your Form Ct 706709 2005 online today for accurate and efficient filing.

To file an income tax declaration form, begin by gathering all relevant financial documents for the year. After completing the appropriate form, you can submit it electronically if applicable, or send it by mail to your local tax office. Platforms like USLegalForms can assist you in finding the right forms and guidance tailored to your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.