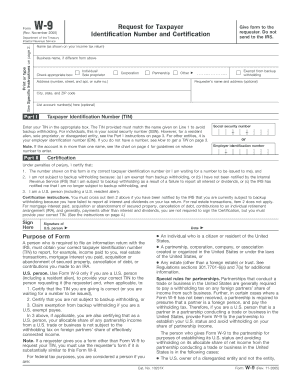

Get Form W-9 (rev. November 2005) (fill-in Capable)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-9 (Rev. November 2005) (Fill-In Capable) online

This guide provides clear, step-by-step instructions on how to complete the Form W-9 (Rev. November 2005) online. It is designed to assist users of all backgrounds, ensuring they can easily provide their taxpayer identification information accurately.

Follow the steps to fill out the form online.

- Press the ‘Get Form’ button to access the fillable W-9 form and open it in your online document editor.

- Enter your name as shown on your income tax return in the designated field. If you have a different business name, include it in the 'Business name' field.

- Check the appropriate box that corresponds with your entity type: 'Individual/Sole proprietor,' 'Corporation,' 'Partnership,' or 'Other.' If you are exempt from backup withholding, check that box as well.

- In the Address section, fill in your address, including the street number, apartment or suite number, city, state, and ZIP code.

- Provide your Taxpayer Identification Number (TIN). For individuals, this is typically your Social Security Number (SSN). If you are a sole proprietor with an Employer Identification Number (EIN), you can enter either number.

- Review the Certification section. You must sign and date the form, ensuring you certify under penalties of perjury that the information provided is accurate.

- Once you have completed all sections, you can choose to save your changes, download the form, print it, or share it with the requester.

Complete your documents online for a seamless experience!

When you need someone to fill out the Form W-9 (Rev. November 2005) (Fill-In Capable), kindly explain why you need their tax information. Clearly state that it's for tax reporting purposes, and ensure they understand the importance of providing accurate details. You might say something like, 'For our records and your tax compliance, could you please complete this W-9 form?' Communicating your request in a straightforward manner helps establish trust.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.