Get 2006 Form 8901

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Form 8901 online

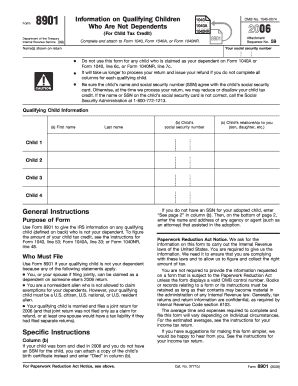

Filling out the 2006 Form 8901 online is a crucial step for individuals claiming the child tax credit for qualifying children who are not dependents. This guide provides clear, step-by-step instructions to help you accurately complete the form and ensure a smooth filing process.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the 2006 Form 8901 and open it in your preferred editing platform.

- Begin by entering the name(s) as shown on your tax return in the designated field on the form.

- Write your social security number in the appropriate section, ensuring accuracy to avoid potential processing delays.

- Carefully fill out the information for each qualifying child in the provided columns. For each child, include their first name, last name, and social security number.

- In the relationship column, specify each child's relationship to you, such as 'son', 'daughter', or another relation.

- Review the cautions listed on the form to ensure no children claimed as dependents on Form 1040A or Form 1040 are included here.

- Check to confirm that the child's name and social security number match exactly what is on their social security card.

- If applicable, for adopted children without an SSN, enter 'See page 2' in the SSN column, and note the agency or attorney’s contact details on the second page.

- Once all fields are accurately completed, save any changes you’ve made to the form.

- Finally, download, print, or share the completed Form 8901 as needed for your tax filing requirements.

Complete Form 8901 online today to ensure you receive the child tax credit for your qualifying children.

You can claim refundable credits after disallowance by first addressing the reasons for the disallowance. This often requires filling out the 2006 Form 8901 and correcting any errors or issues. Once you have all the information, submit an amended tax return with the appropriate documentation. Engaging tools like uslegalforms can make this process smoother and clarify your next steps.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.