Loading

Get Form 8300 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8300 Fillable online

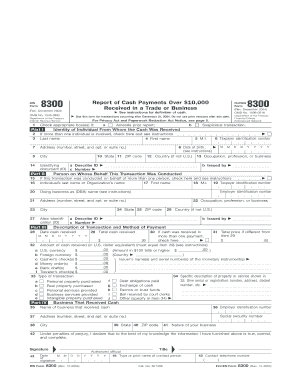

Filling out the Form 8300 Fillable online is an essential process for reporting cash payments over $10,000 received in a trade or business. This guide provides straightforward instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Form 8300 Fillable online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the date of the transaction and check the appropriate box if you are amending a prior report or reporting a suspicious transaction.

- Provide the identity of the individual from whom cash was received by filling out their last name, first name, and address.

- Complete the fields for taxpayer identification number and date of birth, ensuring correct formatting.

- Describe the type of identification document used to verify the identity of the individual providing cash.

- If the transaction was conducted on behalf of multiple people, mark the appropriate box and provide similar details for each individual in Part II.

- Specify the description of the transaction and method of payment in Part III, including total cash received and any other relevant details.

- Finally, complete Part IV with your business information, including employer identification number and nature of your business.

- Review all the entered information for accuracy before submitting.

- Once completed, save changes, and choose to download, print, or share the form as needed.

Complete your documents online with confidence and accuracy.

To save an IRS fillable form, you can use a PDF viewer that supports form filling. After completing the Form 8300 Fillable, you should click ‘Save As’ to choose a location on your device. Make sure to name your file appropriately for easy access later. Using platforms like USLegalForms can simplify this process with clear instructions on saving and managing your documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.