Loading

Get 2006 Form 5695

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Form 5695 online

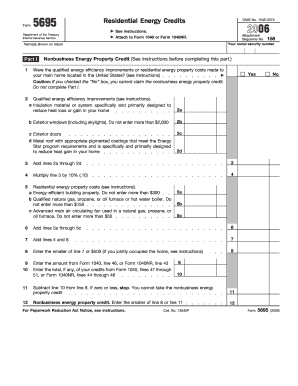

This guide provides detailed instructions on how to complete the 2006 Form 5695 online, specifically designed for claiming residential energy credits. By following these steps, users can easily navigate through the required sections and fields to ensure proper submission.

Follow the steps to complete your form online with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your name(s) as shown on your tax return and your social security number at the top of the form.

- In Part I, indicate whether the qualified energy efficiency improvements were made to your main home located in the United States by checking 'Yes' or 'No'. If 'No', do not complete Part I.

- If 'Yes', fill in the amounts for qualified energy efficiency improvements such as insulation, windows, doors, and metal roofs on lines 2a through 2d.

- Add the amounts from lines 2a through 2d and enter the total on line 3, then calculate 10% of that total and enter it on line 4.

- Record residential energy property costs such as energy-efficient building property and heating appliances on lines 5a through 5c.

- Total the amounts from lines 5a through 5c on line 6, then add the totals from lines 4 and 6 on line 7.

- Enter the smaller of the total from line 7 or $500 on line 8. If applicable, follow the special instructions for joint ownership.

- Proceed to calculate the nonbusiness energy property credit on line 12 by comparing it to line 8.

- For Part II, report any residential energy efficient property costs like solar equipment on lines 13 through 29, following the respective calculations.

- Complete the final calculations and credits on line 31.

- Once you have filled out all sections, make sure to review the form for accuracy and completeness before saving your changes, downloading, printing, or sharing.

Complete your documents online and ensure your energy credits are claimed accurately.

The solar investment tax credit in 2006 offered a 30% tax credit for the installation of solar energy systems. It played a crucial role in incentivizing homeowners to adopt renewable energy. If you're looking to file for this credit, make sure to complete the 2006 Form 5695 accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.