Loading

Get Form 5329 For 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5329 For 2006 online

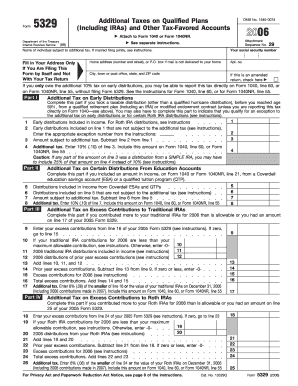

Filling out Form 5329 for 2006 is essential for reporting additional taxes on qualified plans and tax-favored accounts. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out Form 5329 For 2006 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Start by filling in the name of the individual subject to the additional tax. If you are married and filing jointly, refer to the instructions for specific guidance.

- Provide your address only if you are filing this form by itself and not with the main tax return. Enter your social security number in the designated field.

- If this is an amended return, check the corresponding box.

- Complete Part I for additional tax on early distributions. Fill in early distributions included in income and those not subject to additional tax. If applicable, enter the appropriate exception number.

- Calculate the amount subject to the additional tax by subtracting the non-taxed distributions from the total distributions. Then, compute the additional tax based on the determined amount.

- Proceed to complete Part II if you need to report distributions from Coverdell education savings accounts or qualified tuition programs. Follow a similar approach as in Part I.

- Continue to Parts III, IV, V, VI, VII, and VIII as necessary, filling in the required excess contributions and distributions for traditional IRAs, Roth IRAs, Coverdell ESAs, Archer MSAs, HSAs, and minimum required distributions.

- After completing all relevant sections, review the form for accuracy.

- Once finalized, save your changes, and choose to download, print, or share the form as needed.

Complete your Form 5329 online to ensure you meet your tax obligations efficiently.

The IRS considers reasonable causes to be events or circumstances beyond your control that justify late filings or missed payments. Valid reasons often include death, disability, or other extraordinary circumstances. When addressing your situation, particularly for Form 5329 for 2006, it's essential to document these cases clearly to potentially reduce penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.