Loading

Get Irs Form 4422 Fill In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 4422 Fill In online

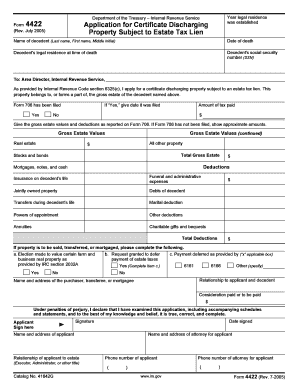

Completing the IRS Form 4422 is essential for applying for a certificate that discharges property subject to an estate tax lien. This guide provides clear, step-by-step instructions to help you fill out the form accurately.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the decedent, including their last name, first name, and middle initial.

- Fill in the date of death of the decedent. This information is crucial for the form processing.

- Provide the decedent's legal residence at the time of death to establish jurisdiction.

- Include the decedent's social security number (SSN) in the designated field.

- Indicate whether Form 706 has been filed by selecting 'Yes' or 'No', and if 'Yes', provide the date it was filed.

- Input the amount of estate tax paid and details regarding gross estate values, including real estate, stocks, bonds, mortgages, and other assets.

- Enter any deductions applicable to the estate such as funeral expenses, debts, and marital deductions.

- If property is being sold, transferred, or mortgaged, respond to the specific questions related to those actions, indicating applicable elections or requests.

- Fill in the relationship to both the applicant and the decedent, along with the name and address of the purchaser or mortgagee.

- Sign the application, including the name and address of the applicant, their relationship to the estate, and the date signed.

- Record the name and address of the applicant's attorney and their phone number. Also, include your phone number.

- Attach any required documents as described in the instructions, which may include a statement of reasons, property descriptions, and the relevant legal documentation.

- Submit your application in duplicate to the appropriate IRS address as specified in the form instructions.

- At the end, save changes, download, print, or share your completed form as needed.

Get started on your IRS Form 4422 online today.

Form 1041 is used to report income generated by an estate or trust, while Form 706 is specifically used for estate tax purposes. Understanding the differences between these forms is essential for proper tax management. Utilizing the Irs Form 4422 Fill In helps clarify when to use each form, ensuring compliance and boosting accuracy in your filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.