Loading

Get 2006 Form 2555 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Form 2555 Fillable online

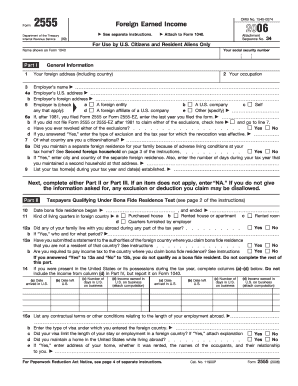

Filling out the 2006 Form 2555 can seem daunting, but with the right guidance, it becomes a manageable task. This guide will walk you through each section of the form, ensuring that you can complete it accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as shown on Form 1040 in the designated field.

- Provide your Social Security number in the corresponding field.

- Fill in your foreign address, including the country, in the specified section.

- Complete the employer’s name and both the U.S. and foreign addresses of your employer.

- Indicate whether your employer is a foreign entity, a U.S. company, self, or other by checking the appropriate box.

- If applicable, provide the last year you filed form 2555 or 2555-EZ after 1981.

- Answer whether you have ever revoked any exclusions, and if so, provide necessary details.

- Indicate the country of which you are a citizen or national.

- If you maintained a separate foreign residence for your family due to adverse conditions, answer ‘Yes’ and provide details.

- List your tax home and the dates established during the tax year.

- For either Part II (bona fide residence test) or Part III (physical presence test), complete the relevant sections as guided.

- For income earned, report all foreign earned income, including wages, bonuses, and other compensations in the appropriate fields.

- After filling out the necessary parts, review the entered information for accuracy.

- Once satisfied, you can save changes, download, print, or share the completed form.

Start completing your forms online today for a stress-free tax season.

Related links form

Filling out the foreign earned income exclusion on the 2006 Form 2555 Fillable involves reporting your total foreign income and claiming the exclusion amount. You must also determine if you meet the physical presence test or bona fide residence test. Guidelines on uslegalforms can streamline this process and ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.