Get 1139 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1139 Form online

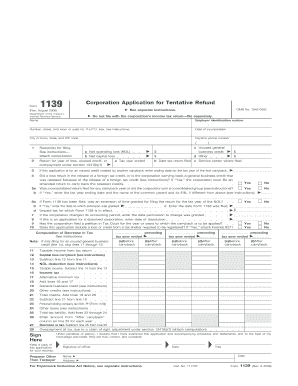

The 1139 Form, officially known as the Corporation Application for Tentative Refund, is used by corporations to apply for a refund of taxes for net operating losses or unused credits. This guide will provide you with clear, step-by-step instructions on how to fill out the 1139 Form online, ensuring you can complete the process efficiently and correctly.

Follow the steps to fill out the 1139 Form online.

- Click ‘Get Form’ button to obtain the form and open it for filling out.

- Begin by entering the corporation's name and employer identification number in the designated fields.

- Provide the corporation's address, including the number, street, and room or suite number. If a P.O. box is used, refer to the instructions provided.

- Enter the date of incorporation, city or town, state, and ZIP code of the corporation.

- Include a daytime phone number for further communication.

- Fill out the financial information in lines 1a through 1d, indicating net operating loss, net capital loss, unused general business credit, and any other relevant amounts.

- Specify the return year for loss, unused credit, or overpayment on line 2.

- If applicable, complete line 3 with the ending date for the tax year of the first carryback.

- Respond to the foreign tax credit question on line 4, indicating 'Yes' or 'No.'

- For consolidated returns, complete lines 5a and 5b as applicable, providing necessary details.

- Continue through lines 6 to 10, addressing any amendments, extensions, or specific circumstances regarding the tax return.

- If required, complete the Computation of Decrease in Tax section, lines 11 through 28, with appropriate figures and deductions.

- Review all entered information to ensure accuracy before finalizing your application.

- Once all sections are completed, users can save changes, download, print, or share the finished form as needed.

Complete your documents online today!

Receiving a 1099 can impact your taxes significantly, as it indicates income that must be reported. Failing to include this income could lead to penalties and interest from the IRS. The key is to accurately report all income to avoid potential issues. If you have deductions or credits, the 1139 Form can help you claim refunds when losses occur, balancing out your tax liability.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.