Loading

Get 2006 Form 944

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Form 944 online

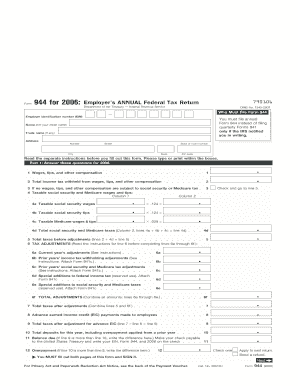

Filling out the 2006 Form 944, the Employer's Annual Federal Tax Return, is essential for employers who have received notification from the IRS to file this form. This guide will provide step-by-step instructions on how to complete the form online, ensuring you meet all requirements accurately and efficiently.

Follow the steps to complete the 2006 Form 944 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in your employer identification number (EIN) at the top of the form, ensuring it is correct to prevent processing delays.

- Provide your name (not the trade name), trade name (if applicable), address, and other identifying information as requested in Part 1.

- Complete lines 1 through 12 in Part 1, detailing wages, income tax withheld, social security and Medicare wages, taxes before and after adjustments, and any overpayments or balances due.

- In Part 2, determine your tax liability for the year by addressing line 13 and providing monthly tax liability if applicable.

- If applicable, indicate any business closure dates in Part 3.

- Decide if you wish to allow a third-party designee to discuss your return with the IRS and fill in the necessary details in Part 4.

- Sign and date the form in Part 5, ensuring all information is complete and accurate.

- If you are using a paid preparer, they should fill out Part 6 with their details.

- Review all provided information, make any necessary edits, and ensure you save changes, download, print, or share the form as needed.

Start completing your 2006 Form 944 online today to ensure timely and accurate submission.

The regular Form 944, often referred to as the Employer's Annual Federal Tax Return, is designed for smaller employers with lower payroll tax liabilities. Most employers can determine their eligibility based on the total annual payroll. If you qualify, filing the 2006 Form 944 simplifies your tax obligations by allowing annual reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.