Get Fill In Form 8821

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill In Form 8821 online

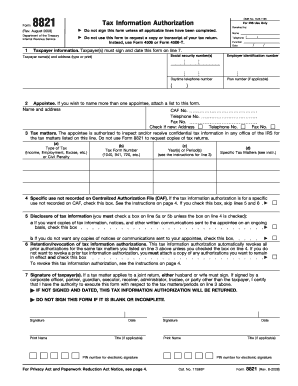

Filling out the Fill In Form 8821 online is a straightforward process that enables you to authorize an individual or entity to receive your confidential tax information from the IRS. This guide provides a clear and comprehensive overview of each section of the form, ensuring that users can complete it accurately and efficiently.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In section 1, provide your taxpayer information, including your name, social security number, and address. Ensure that both taxpayers sign and date the form on line 7.

- In section 2, enter the appointee's name, address, and CAF number. If naming multiple appointees, attach an additional list.

- In section 3, specify the tax matters for which the appointee is authorized. Include the type of tax (e.g., income), tax form number (e.g., 1040), relevant year(s), and any specific tax matters.

- In section 4, check the box if the authorization is for a specific use not recorded on the Centralized Authorization File (CAF). If checked, skip sections 5 and 6.

- In section 5, indicate your preference for disclosure of tax information. Choose to send copies of communications to your appointee or not.

- In section 6, if you do not wish to revoke prior authorizations, attach the relevant documentation and check the appropriate box.

- Lastly, in section 7, sign and date the form. If applicable, enter your title and provide a PIN number for electronic signatures.

- After completing the form, save your changes. You can then download, print, or share the completed Form 8821 as needed.

Complete your Forms online today to ensure accurate and timely submissions.

Taxpayers who are subject to self-assessment for their income, such as self-employed individuals or those with certain income types, may need to fill in a self-assessment form. This process helps ensure proper reporting of income and tax liability. If you’re uncertain about your requirements, consider consulting with a tax professional who can guide you through the necessary forms, including Form 8821 if needed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.