Loading

Get Form 8300

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8300 online

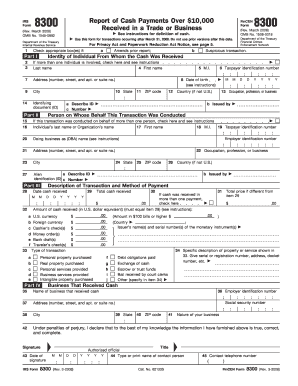

Filling out Form 8300 is essential for reporting cash payments received in excess of $10,000 in a trade or business. This guide provides clear, step-by-step instructions to help users complete the form online efficiently and accurately.

Follow the steps to complete Form 8300 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I of the form, checking the appropriate box if you are amending a prior report or if multiple individuals are involved in the transaction. Fill in the last name, first name, and middle initial of the person involved, along with their address, city, state, and ZIP code.

- Provide the date of birth of the individual and their taxpayer identification number. Include their occupation, profession, or business in the designated field.

- For the person on whose behalf the transaction was conducted, fill out their information, including last name, first name, and any applicable ‘doing business as’ (DBA) name.

- Successively complete Part III, noting the date cash was received and the total amount in cash. Summarize the methods of payment in detail, including foreign currency amounts if applicable.

- Select the type of transaction from the provided options. If the transaction does not fit into the specified categories, check the option for 'Other' and provide a brief description.

- Conclude with Part IV where you provide the business name that received the cash, the nature of the business, and complete the signature section, ensuring the document is authorized and dated.

- Finally, review all information for accuracy and completeness before saving changes, downloading, printing, or sharing the completed form.

Ensure compliance and complete your Form 8300 online today.

You can obtain Form 8300 directly from the IRS website or through tax preparation software that includes IRS forms. Furthermore, US Legal Forms offers a user-friendly platform to access and obtain Form 8300 quickly and efficiently, ensuring you have the necessary paperwork at your fingertips to meet compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.