Loading

Get 2007 Form 6251

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Form 6251 online

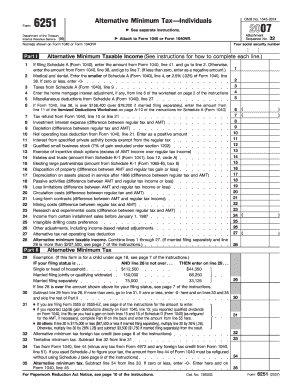

Filling out the 2007 Form 6251 can initially seem complex, but this guide provides a clear and thorough walkthrough. By following these steps, users can confidently complete the form and ensure accurate reporting of their alternative minimum tax.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to retrieve the form and open it in your preferred editor.

- Begin with Part I by entering your name as it appears on Form 1040 or Form 1040NR at the top of the form. This identification is essential for processing.

- Record the alternative minimum taxable income by filling out lines 1 through 28. Each line corresponds to specific adjustments and deductions; make sure to consult any relevant instructions for details.

- Move on to Part II. Here, calculate your alternative minimum tax exemption based on your filing status and the parameters provided in the form.

- Subtract the exemption amount from the alternative minimum taxable income. If the result is greater than zero, proceed with the calculation of your alternative minimum tax.

- Complete Part III if applicable, which involves additional tax computations based on capital gains and qualified dividends.

- Once all entries are made and calculations are complete, review your entries for accuracy. Make any necessary corrections.

- Finally, save your changes, and choose to download, print, or share the completed form as needed for submission.

Take the next step in managing your taxes effectively by filing documents online.

The threshold for filing the 2007 Form 6251 is based on your income and the allowable deductions affected by AMT. If your income surpasses specific limits, you may need to file to determine your tax liability. Keeping track of your gross income and claimed deductions will help you understand your filing requirements. Platforms like US Legal Forms can simplify this analysis and help you make informed decisions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.