Get 2007 Form 5695

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Form 5695 online

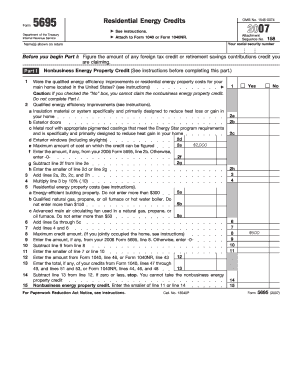

Filling out the 2007 Form 5695 is an essential process for individuals looking to claim residential energy credits. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring you can efficiently navigate each section.

Follow the steps to accurately complete the 2007 Form 5695.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as shown on your tax return and provide your social security number in the designated fields.

- Before beginning Part I, determine the total amount of any foreign tax credit or retirement savings contributions credit you are claiming.

- In Part I, respond to the question regarding whether the qualified energy efficiency improvements or residential energy property costs were for your main home located in the United States. If 'No,' do not complete this section.

- Report the costs for qualified energy efficiency improvements such as insulation, exterior doors, or metal roofs in the specified fields (2a, 2b, and 2c).

- Calculate your total qualified expenses by adding the amounts from lines 2a, 2b, and 2c. Multiply this total by 10% and enter the result on line 4.

- Next, enter any costs associated with residential energy property such as heating systems on lines 5a through 5c.

- Sum the values on lines 4 and 6 to find your maximum credit amount and complete lines 8 through 15 to finalize your credit calculation.

- Move on to Part II if claiming the Residential Energy Efficient Property Credit. Report the qualified solar electric, water heating, and fuel cell property costs in the designated lines.

- After completing both parts, review all entries for accuracy. Save your changes, and you can then download, print, or share the completed form.

Complete your documents online now to ensure you claim your eligible energy credits.

The maximum energy star tax credit for homeowners using the 2007 Form 5695 can be significant. For qualifying energy-efficient improvements, you may claim a credit of up to $500. It's essential to review the specific guidelines of the 2007 Form 5695 to understand eligibility and how to apply these credits correctly. Keep in mind that this credit applies to various improvements, so it encourages energy savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.