Get 5304 Simple 2005 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5304 Simple 2005 Form online

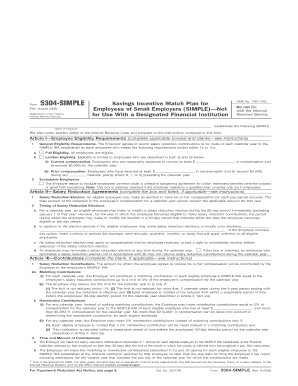

Filling out the 5304 Simple 2005 Form online is an important step for small employers looking to establish a Savings Incentive Match Plan for their employees. This guide will help users navigate through the form efficiently and accurately.

Follow the steps to complete your 5304 Simple 2005 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide the name of your company where indicated as 'Name of Employer'. Ensure that you include complete and accurate information as this is crucial for the legitimacy of the document.

- Proceed to Article I, and select the eligibility requirements for your employees by checking the appropriate box, either for full eligibility or limited eligibility. Fill in the required financial amounts where applicable.

- Move to Article II where you will define salary reduction agreements. Here, indicate how eligible employees can elect to have their compensation reduced for contributions and any timing modifications you would like to apply.

- In Article III, outline the contributions to be made. This includes setting up salary reduction contributions and determining whether to offer matching contributions or nonelective contributions. Fill in the required limits as applicable.

- Continue to Article IV and specify any other requirements and provisions, including vesting requirements and withdrawal restrictions, if applicable.

- Complete Article VII by inserting the effective date of your SIMPLE IRA plan. Ensure this date aligns with your planning and is within the appropriate timeframe.

- After filling out all relevant sections, review the form for accuracy and completeness. Then, save your changes, download a copy for your records, print if necessary, or share the completed form as required.

Start completing your documents online today to ensure your retirement plans for employees are set up efficiently.

The 5304-SIMPLE form is a specific IRS document used to establish a SIMPLE IRA plan that allows employees to choose their financial institution. This form simplifies the setup of a SIMPLE IRA while providing flexibility and tax benefits to both employers and employees. By filling out the 5304 Simple 2005 Form, employers can offer their employees a beneficial retirement savings option. For guided assistance, consider using the US Legal Forms platform to ensure accurate compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.