Loading

Get Form 4562

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4562 online

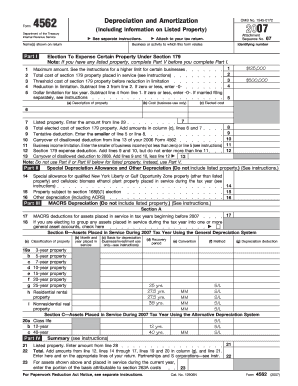

Filling out Form 4562 is essential for accurately reporting depreciation and amortization for your business. This guide will walk you through each section of the form, helping you successfully complete it online.

Follow the steps to accurately complete Form 4562.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name(s) shown on the return at the top of the form. Ensure that this matches your tax return information.

- In Part I, provide your business or activity identifying number and the maximum amount applicable under Section 179. Make sure to refer to the instructions for specific thresholds.

- List out all section 179 property placed in service in the current tax year. Record the description of the property, its cost, and the elected cost in the provided columns.

- Calculate the total elected cost of section 179 property. Ensure you add the amounts accurately before proceeding to calculate the tentative deduction.

- If applicable, complete Part II for special depreciation allowances and other depreciation, following the specific guidelines provided in the instructions.

- In Part III, report MACRS depreciation by filling out the classification of property, month and year placed in service, and other required details for assets placed in service during the current or previous tax years.

- Complete Part IV with a summary of all depreciation and amortization amounts calculated. This is critical for determining amounts to enter on your tax return.

- If you have listed property, navigate to Part V and provide details regarding the business use of vehicles and other properties, ensuring you answer all yes/no questions as applicable.

- Finally, review all filled sections for accuracy. Save your changes, and consider downloading, printing, or sharing the completed form for your records.

Complete your Form 4562 online today to ensure accurate reporting of your depreciation and amortization.

You must file Form 4562 if you want to claim depreciation or if you’re using bonus depreciation for your assets. This form is essential for reporting the depreciation on property placed in service during the tax year. Failing to file could lead to lost deductions and financial setbacks. Use US Legal Forms to access the necessary documentation easily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.