Get Irs Form 966 Certified Copy Resolution

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 966 Certified Copy Resolution online

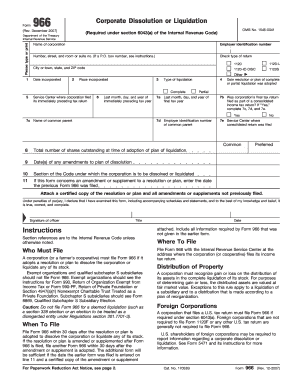

Filling out the IRS Form 966 Certified Copy Resolution is essential for corporations planning to dissolve or liquidate. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the IRS Form 966 online.

- Click ‘Get Form’ button to download the form and open it in your preferred editor.

- In the first section, enter the corporation's name and employer identification number at the designated fields.

- Provide the corporation’s address, ensuring to include the number, street, and any suite or room number if applicable.

- Check the appropriate type of return being filed, selecting from options such as 1120, 1120-L, or other relevant categories.

- Indicate the date of incorporation, and state the place of incorporation in the respective fields.

- Specify the service center where the corporation filed its immediately preceding tax return.

- Select the type of liquidation, marking ‘Complete’ or ‘Partial’ as applicable.

- Fill in the last month, day, and year of the immediately preceding tax year.

- If relevant, complete section 7b regarding whether the final tax return was filed as part of a consolidated return. If 'Yes,' provide the requested information in 7c, 7d, and 7e.

- Enter the total number of shares outstanding at the time of the plan's adoption in section 9.

- Identify the section of the Internal Revenue Code under which the corporation will be dissolved or liquidated.

- Attach a certified copy of the resolution or any amendments not previously filed. Ensure the form is correctly signed by an authorized officer and dated.

- Review all entries for accuracy before submitting. Finally, save changes, download, print, or share the completed Form 966.

Ensure you follow these instructions carefully to complete your IRS Form 966 online with ease.

A board resolution to dissolve a corporation is a formal record documenting the decision made by the board of directors to terminate the corporation's existence. This resolution is usually a prerequisite for filing IRS Form 966, as it provides proof of the intent to dissolve. Maintaining a certified copy of this resolution is important for compliance purposes. USLegalForms can help you draft and file the necessary documents accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.