Loading

Get Form 8863 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8863 Instructions online

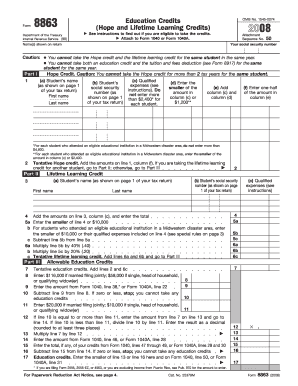

Filling out Form 8863 is an essential step for individuals looking to claim education credits for eligible expenses. This guide will walk you through each section of the form, ensuring that you understand how to accurately complete it online.

Follow the steps to complete the Form 8863 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name(s) shown on your tax return and your social security number at the top of the form. Make sure this information matches what is on your official documents.

- In Part I, identify if you are applying for the Hope Credit. For each qualifying student, provide their name and social security number. Enter the qualified expenses incurred, making sure to adhere to the limits set for the Hope Credit.

- Calculate and enter the tentative Hope Credit by first adding up the qualified expenses and following the specific instructions for that section.

- Move to Part II if you are applying for the Lifetime Learning Credit for another student. Input the necessary details for each qualifying student. Remember to check against the maximum allowable credits.

- In Part III, review your total education credits. If applicable, complete the applicable lines by entering your adjusted gross income and any calculated amounts as indicated in the instructions.

- Once all sections are complete, make sure to double-check your entries for accuracy. Save any changes, and you can choose to download, print, or share the form as needed.

Complete your Form 8863 online to ensure you receive the educational credits you are eligible for.

To file an American Opportunity tax credit, complete Form 8863, following the detailed Form 8863 Instructions. This form requires information about qualified education expenses and your eligibility. You can e-file or mail your tax return, depending on your preference, ensuring you include your completed Form 8863 for consideration of the credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.