Loading

Get 2008 Irs Form 8801

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 IRS Form 8801 online

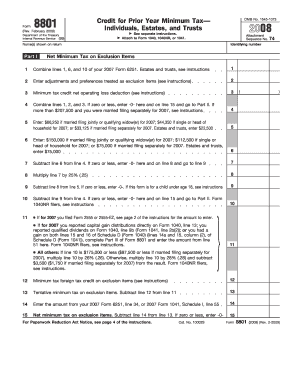

Filling out IRS Form 8801 can seem daunting, but with the right guidance, you can complete it efficiently. This form allows individuals, estates, and trusts to claim a credit for prior year minimum tax.

Follow the steps to complete IRS Form 8801 online.

- Click 'Get Form' button to access the IRS Form 8801 and open it in your document viewer.

- On the form, begin by reviewing Part I, where you will calculate your net minimum tax on exclusion items. Combine the applicable lines from your 2007 Form 6251.

- Enter any adjustments and preferences treated as exclusion items. Ensure you have the correct adjustment figures from your prior year forms.

- Complete the calculations related to minimum tax credit net operating loss deductions and continue to follow the steps until you reach Part II.

- In Part II, fill in the amounts derived from previous calculations, ensuring that you carefully monitor the subtraction lines for accurate values.

- Proceed to Part III for specific tax computations if applicable. Follow the instructions provided for entering amounts from your 2007 worksheets.

- Lastly, complete Part IV as necessary. Check all amounts and ensure that your total credits and carryforwards are correctly calculated and entered.

- Once all sections are complete, you can save your changes, download the filled form, print it, or share it as required.

Complete your IRS Form 8801 online today to ensure you claim your due credit.

To claim an AMT tax credit, you need to accurately fill out the 2008 IRS Form 8801 and ensure you have all your AMT records from previous years. This form facilitates the recovery of your AMT credits. If you need assistance, consider using USLegalForms for a streamlined process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.