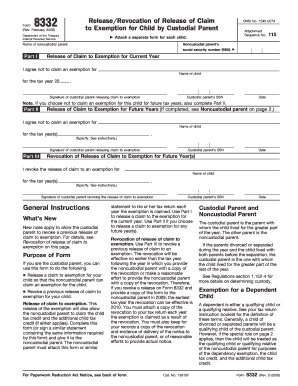

Get Form 8332 (rev. 2-2009). Release/revocation Of Release Of Claim To Exemption For Child By Custodial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8332 (Rev. 2-2009). Release/Revocation Of Release Of Claim To Exemption For Child By Custodial online

Form 8332 is a crucial document for custodial parents managing tax exemptions related to their children. This guide provides clear, step-by-step instructions to help you fill out the form effectively and accurately, whether you are releasing or revoking a claim.

Follow the steps to fill out Form 8332 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Complete Part I to release a claim to exemption for your child for the current tax year. Enter the name of the noncustodial parent, their social security number, and the name of the child in the designated fields.

- Sign and date the form in the specified areas to acknowledge your agreement not to claim the exemption for the tax year.

- If you wish to also release a claim for future years, complete Part II by indicating the specific year(s) you agree not to claim the exemption.

- For revocation of a previous claim, complete Part III by specifying the year(s) for which you are revoking the exemption.

- After thoroughly reviewing the form for accuracy, save your changes, and then download, print, or share the completed form as needed.

Start completing your Form 8332 online today to ensure proper management of your tax exemption.

To complete Form 8332 (Rev. 2-2009). Release/Revocation Of Release Of Claim To Exemption For Child By Custodial, start by gathering the necessary information about your child and your agreement with the other parent. The form includes sections for both parents to provide their details and consent. For additional guidance, consider using USLegalForms, which provides templates and assistance to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.