Loading

Get 2008 Form 4626

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Form 4626 online

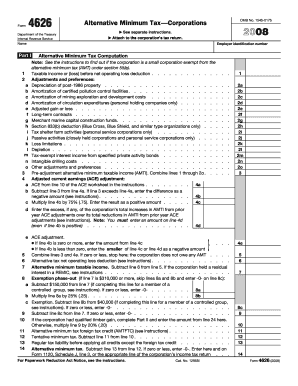

The 2008 Form 4626 is essential for corporations calculating their alternative minimum tax. This guide provides step-by-step instructions to help users complete the form accurately and efficiently in an online format.

Follow the steps to fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the corporation in the designated field. Ensure that the name matches the corporation's official records.

- Provide the employer identification number in the relevant section. This number is crucial for identifying the corporation.

- Complete Part I by filling in the taxable income or loss before any deductions. Carefully review this figure to ensure accuracy.

- List all adjustments and preferences by entering the required amounts for each adjustment category, such as depreciation and amortization, as applicable.

- Calculate the pre-adjustment alternative minimum taxable income by summing all amounts entered in Part I, lines 1 through 2o.

- Complete the Adjusted Current Earnings (ACE) adjustment section as directed, ensuring to follow any specific instructions for negative amounts.

- Enter the alternative tax net operating loss deduction if applicable. Refer to the instructions if unsure.

- Calculate the alternative minimum tax by following the instructions on line 14, ensuring to gather total tax information accurately.

- If applicable, complete Part II for Corporations with Qualified Timber Gain by entering the necessary figures as instructed.

- Review all entries for accuracy. Once you have filled the form completely, save changes, download, print, or share the form as needed.

Complete your 2008 Form 4626 online today for an efficient filing experience.

Individuals and entities that need to calculate their Alternative Minimum Tax (AMT) must fill out the 2008 Form 4626. This includes taxpayers who have certain types of income or specific deductions that can trigger the AMT. If you are unsure about your requirements, consulting the USLegalForms platform can help clarify who needs to complete this form based on their tax situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.