Loading

Get 2008 Form 2555

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Form 2555 online

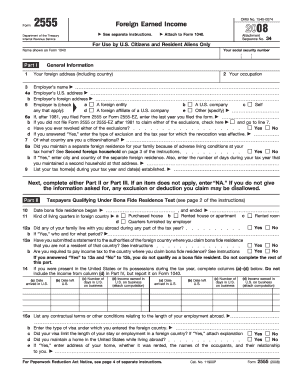

Completing the 2008 Form 2555 online can streamline the process for U.S. citizens and resident aliens seeking to claim foreign earned income exclusions. This guide will walk you through each section of the form, ensuring you fill it out correctly and efficiently.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Part I, enter your name exactly as it appears on Form 1040 and your social security number. Provide your foreign address including the country. List your occupation, the name, and addresses of your employer.

- Indicate the nature of your employer by checking the applicable boxes: foreign entity, U.S. company, self, foreign affiliate of a U.S. company, or other.

- If you have filed Form 2555 or Form 2555-EZ in previous years, note the last year you filed. Confirm whether you have ever revoked either of the foreign earned income exclusions.

- State your citizenship or nationality, and mention if you maintained a separate foreign residence due to adverse living conditions.

- Proceed to either Part II or Part III based on your qualifying test — bona fide residence or physical presence.

- In Part II, detail your date of bona fide residence, your living quarters, and whether you had family living with you abroad.

- Provide details of your presence in the U.S. during the tax year, including travel dates and income earned in the U.S.

- For Part III, record the details of your physical presence test, including dates of entry and exit from various countries.

- In Part IV, report all income in U.S. dollars for foreign services performed during the 2008 tax year. Include applicable income such as wages and bonuses.

- Part V allows you to claim the housing exclusion or deduction. Fill in the necessary figures and calculations carefully.

- After reviewing all sections, make sure to save your changes and choose to download, print, or share the completed form as needed.

Begin completing your 2008 Form 2555 online now.

You can find the 2008 Form 2555 on the official IRS website or through tax preparation software. The form is readily available for download and includes specific instructions for completion. Just search for 'Form 2555' in the IRS forms section. Additionally, US Legal Forms can help you locate the form and provide you with templates to streamline filling it out.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.