Get From 944

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 944 online

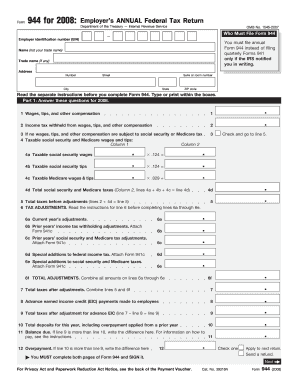

Filling out Form 944, the employer's annual federal tax return, is an important task for reporting employment taxes. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring that you accurately report your tax information.

Follow the steps to fill out Form 944 online.

- Use the ‘Get Form’ button to access the form and open it in your chosen editor.

- Enter your employer identification number (EIN) in the designated field. Ensure it is accurately entered to avoid processing issues.

- Provide your name (not your trade name), trade name (if applicable), and your complete address, including street, suite or room number, city, state, and ZIP code.

- In Part 1, report wages, tips, and other compensation in line 1. Follow the instructions provided to fill in the income tax withheld in line 2.

- If no wages are subject to social security or Medicare tax, check the relevant box and move to line 5.

- Calculate the total taxable social security and Medicare wages and tips in lines 4a, 4b, and 4c. Add these amounts together to complete line 4d.

- Compute your total taxes before adjustments by adding line 2 and line 4d. Enter this total in line 5.

- If applicable, report any tax adjustments by filling out lines 6a through 6e based on the provided instructions, then total these adjustments in line 6f.

- Calculate the total taxes after adjustments by adding line 5 and line 6f to complete line 7.

- Input the amount for the advance earned income credit (EIC) payments made to employees in line 8.

- Subtract line 8 from line 7 to obtain the total taxes after adjustment for advance EIC, and enter this in line 9.

- Report total deposits for the year in line 10, and if applicable, determine the balance due or overpayment in lines 11 and 12.

- Complete Part 2 by indicating your tax liability for the year, checking the corresponding box in line 13.

- In Part 3, if your business has closed, check the box and provide the final date you paid wages.

- Decide whether you wish to allow a third-party designee to discuss your return with the IRS in Part 4.

- In Part 5, ensure to sign and date the form. If you have a preparer, they will also need to sign and provide their information.

- Review the completed Form 944 carefully. Once verified, save your changes, download the form, print it, or share it as necessary.

Complete your documents online today to ensure timely and accurate filing.

The regular Form 944 is an annual payroll tax form designed for small employers, allowing them to report withheld income tax, Social Security tax, and Medicare tax for the entire year. This form simplifies the filing process for businesses that meet certain criteria, making it easier to manage payroll responsibilities. Using uslegalforms can assist you in accurately completing and filing Form 944, ensuring you remain compliant with federal tax regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.