Loading

Get Form 941x 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941x 2009 online

Filling out Form 941x allows you to correct errors made in your previously filed Form 941 or 941-SS. This guide provides detailed, step-by-step instructions to help you accurately complete the form online.

Follow the steps to correctly complete and submit your 941x form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

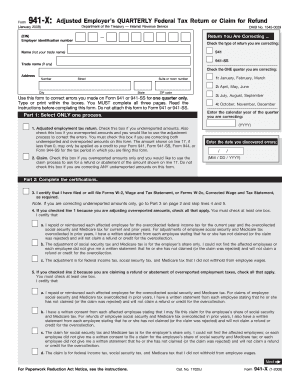

- Begin by identifying the type of return you are correcting. Select either 941 or 941-SS and specify the quarter you are correcting by checking the appropriate box.

- Enter your employer identification number (EIN) and complete the name and address sections. Ensure all information is accurate to avoid processing delays.

- In Part 1, select the correction process that applies to your situation: choose the adjustment process if you are correcting underreported amounts or both underreported and overreported amounts, or select the claim process for overreported amounts only.

- In Part 2, complete the certifications based on the selected correction process. Provide the necessary certifications by checking the corresponding boxes that apply to your situation.

- Next, in Part 3, enter the corrections for each applicable line. Use the columns provided to report total corrected amounts, amounts originally reported, and calculate the differences.

- In Part 4, explain your corrections in detail, including any underreported and overreported amounts, and ensure clarity in your explanation.

- Finally, in Part 5, sign and date the form. Ensure that the declaration is complete and that the form consists of all required three pages before finalizing.

- Finish by saving your changes, then download, print, or share the completed form as needed.

Complete your Form 941x online today to ensure your corrections are filed accurately!

You should send your Form 941x 2009 to the address specified by the IRS for your region. This may vary depending on whether you are including any payments with your form. Always check the latest IRS guidelines to ensure you use the correct mailing address for your Form 941x to avoid delays.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.