Get 8880 Form 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8880 Form 2009 online

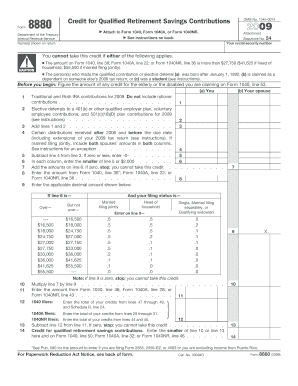

The 8880 Form, designed for credit for qualified retirement savings contributions, is an important tool for individuals looking to claim savings contributions credits. This guide will provide you with clear, step-by-step instructions on how to accurately fill out the form online.

Follow the steps to efficiently complete the 8880 Form 2009 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin filling out the form by entering your name and Social Security number at the top of the page, as shown on your tax return.

- Review the eligibility requirements stated in the instructions. Ensure you are qualified for the credit before proceeding.

- Enter the amounts for traditional and Roth IRA contributions for 2009 on line 1 of the form. Do not include rollover contributions.

- Input the amounts for elective deferrals to a 401(k) or other qualified plans on line 2. Be sure to refer to your W-2 forms for accuracy.

- Add the values from lines 1 and 2 and place the total on line 4.

- Follow the instructions to complete lines 5 through 9, ensuring you check for any distributions received that affect your calculations.

- Complete lines 10 through 12 by calculating the credit amount you may claim based on the values provided earlier.

- Once all lines are filled, review the form for any errors or omissions.

- Save your changes, and you may choose to download, print, or share the completed form as needed.

Start filling out your 8880 Form online today to ensure you receive your rightful credits.

Information for the 8880 Form 2009 can be gathered from the IRS website, which provides detailed instructions and guidelines. You can also refer to tax preparation guides that outline the requirements and processes for filling out the form. Additionally, USLegalForms is a valuable resource that simplifies understanding and completing Form 8880, allowing you to maximize your retirement savings credit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.