Get 2009 Form 8863

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Form 8863 online

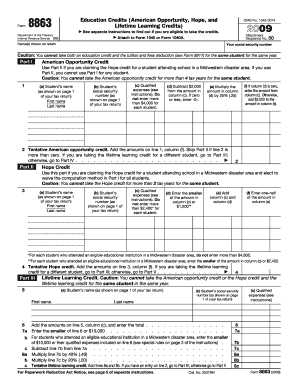

Filling out the 2009 Form 8863 for education credits can be straightforward with the right guidance. This form allows users to claim the American Opportunity, Hope, and Lifetime Learning credits, which can provide important tax benefits for educational expenses.

Follow the steps to complete the 2009 Form 8863 online.

- Click ‘Get Form’ button to obtain the form and open it for editing online.

- Begin by entering the name(s) shown on your tax return in the designated fields. Ensure that the names are exactly as they appear on the return.

- Input your social security number in the appropriate field. This is essential for identification purposes.

- In Part I for the American Opportunity Credit, fill in the student’s name and social security number. Then enter the qualified expenses incurred, ensuring it does not exceed $4,000 for each student.

- Subtract $2,000 from the qualified expenses entered in the previous step, and if the result is zero or less, enter -0- in the provided field.

- Multiply the resulting amount from the previous step by 25% (0.25) and enter this amount.

- If applicable, proceed to Part II for the Hope Credit. Fill in the same fields for the student’s name and social security number. Enter the qualified expenses, not exceeding $2,400.

- Complete the calculations in Part II based on the amounts entered and proceed to Part III for the Lifetime Learning Credit, following a similar method to inputting the relevant details and expenses.

- Review parts IV and V for refundable and nonrefundable credits. Carefully enter the required amounts and calculations as outlined in the form.

- Once all sections of the form are filled out, ensure you review your entries for accuracy. Then, save your changes, download the completed form, print it, or share it as necessary.

Complete your 2009 Form 8863 online today and take advantage of the available education credits.

To claim the American Opportunity Tax Credit using the 2009 Form 8863, you'll first need to ensure that you have qualified educational expenses. Complete the form carefully, detailing your qualified spending on tuition and other eligible fees. Submit the form with your tax return to the IRS. This credit can significantly reduce your tax bill, so it's essential to follow the instructions closely.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.