Get 2009 Form 6765

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Form 6765 online

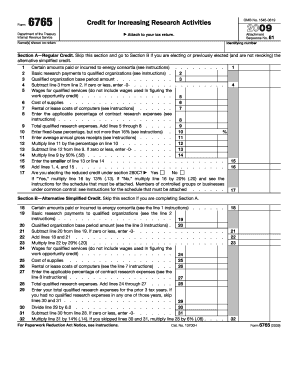

Filling out the 2009 Form 6765, which is used to claim the credit for increasing research activities, is a crucial step for eligible taxpayers. This guide provides clear, step-by-step instructions to assist users in completing the form online efficiently and accurately.

Follow the steps to successfully complete the 2009 Form 6765 online.

- Press the ‘Get Form’ button to access the 2009 Form 6765 and open it in your document editor.

- Identify the identifying number section and enter the appropriate information as it appears on your tax return.

- Fill in the name(s) shown on your return in the designated field.

- Decide which section to complete: Section A (Regular Credit) or Section B (Alternative Simplified Credit), and proceed accordingly.

- For Section A, begin by entering amounts on line 1 for certain research payments to energy consortia. Line 2 requires entering basic research payments made to qualified organizations.

- Continue with lines 3 through 17, which involve calculations related to qualified research expenditures, based on guidance provided in the instructions.

- If completing Section B, enter applicable amounts starting at line 18 and follow through to line 34, ensuring that each entry reflects the necessary information.

- Finally, complete Section C, the summary section, by transferring the appropriate amounts from previous sections to lines 35 through 40.

- Review all entries for accuracy, then save your changes, download the completed form, print, or share it as needed.

Complete your 2009 Form 6765 online to ensure you claim the correct credit for your research activities.

To calculate the fixed base percentage, gather your average qualifying research expenses and gross receipts over the appropriate timeframe. This ratio will help determine the baseline for your R&D tax credit as represented on the 2009 Form 6765. It’s a critical calculation, and doing it correctly can maximize your tax savings and ensure you are leveraging all available credits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.