Get F2555 2009 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F2555 2009 Form online

This guide provides you with a comprehensive overview of how to effectively complete the F2555 2009 Form online. By following these steps, you will ensure that you accurately report your foreign earned income and qualify for applicable exclusions.

Follow the steps to successfully complete the F2555 2009 Form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

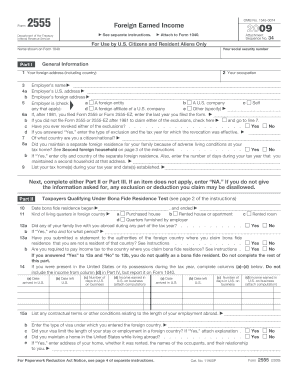

- Begin by filling in your personal details in Part I: General Information. This includes your social security number, name as shown on Form 1040, and your foreign address. Be thorough and ensure that all details are accurate.

- Provide your occupation and the name of your employer, along with both U.S. and foreign addresses of your employer. Indicate the type of employer by checking the relevant boxes.

- In Part I, complete sections that ask about any previous filings of Form 2555 or 2555-EZ since 1981, your citizenship country, whether you maintained a separate foreign residence, and details about your tax home.

- Move to either Part II (Bona Fide Residence Test) or Part III (Physical Presence Test) based on your situation. Provide all required dates and information to establish your eligibility.

- For Part IV, report all foreign earned income amounts accurately, including any noncash income and allowances. Use accurate exchange rates and be sure not to include ineligible income.

- Proceed to Part V if you are claiming housing exclusions or deductions. Carefully fill out all relevant sections and details regarding your housing expenses.

- Review the completed form thoroughly to ensure all entries are correct and according to IRS instructions. Pay attention to the calculation of any exclusions.

- Finally, preserve your changes by saving the completed form. You can also download, print, or share the form as necessary.

Complete your F2555 2009 Form online now for an efficient filing experience.

The F2555 2009 Form is an IRS tax form used to report foreign earned income and claim exclusions for that income. Completing this form allows you to reduce your taxable income if you meet specific eligibility criteria. Using this form correctly can lead to significant tax savings for expatriates. If you have questions about filling it out, platforms like uslegalforms can provide assistance to ensure you maximize your benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.