Loading

Get 1040 Pr 2009 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040 Pr 2009 Form online

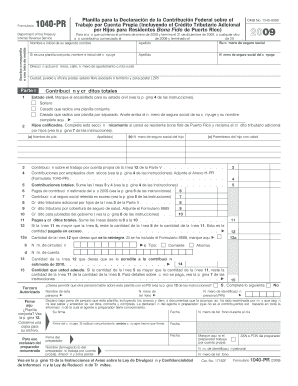

Filling out the 1040 Pr 2009 Form online can seem daunting, but with a clear guide, users can navigate the process with ease. This comprehensive guide will provide step-by-step instructions to ensure that every field is filled out correctly and efficiently.

Follow the steps to successfully complete your form online

- Click the ‘Get Form’ button to obtain the 1040 Pr 2009 Form and open it for editing.

- Begin by entering your social security number, full name, and the name and initial of your spouse if filing jointly. Make sure all names are spelled correctly.

- Fill in your current address, including your apartment number or rural route, city, and ZIP code. Ensure that this information is up to date as it plays a crucial role in correspondence.

- Indicate your marital status by marking the appropriate checkbox. Choose from single, married filing jointly, or married filing separately. If married filing separately, ensure you enter your spouse's social security number.

- If applicable, complete the section for qualified children only if you are a bona fide resident of Puerto Rico. Input their names, social security numbers, and their relationship to you.

- In Part I, total your self-employment income and any additional credits. Be precise while adding contributions and credits to prevent errors.

- Proceed to complete Part II regarding income from Puerto Rico sources and other eligible credits. Follow the specific instructions provided in the form.

- In Part III, report any gains or losses from agricultural business and enter the relevant figures in the designated sections. Ensure everything aligns with your assets and liabilities.

- Once you have completed all sections of the form, double-check for accuracy and completeness. Look for any required attachments as specified in the instructions.

- Finally, save your changes, download the form for your records, print a hard copy if necessary, or share it as required.

Get started on filing your documents online now.

Yes, Form 1040 is often synonymous with the federal tax return for U.S. taxpayers. When you file Form 1040, you are essentially submitting your federal tax return to the IRS. For residents in places like Puerto Rico, understanding how the 1040 Pr 2009 Form fits into your tax return process is critical to ensure compliance. Using the right form helps you report your income accurately and claim eligible deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.