Get What Is Form 2055 Irs For 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Form 2055 IRS For 2010 online

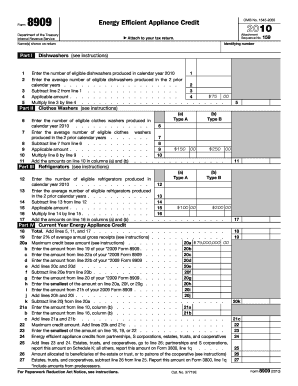

Filling out Form 2055 for the year 2010 can seem challenging, but this guide is designed to help you navigate through the process smoothly. This form allows manufacturers to claim energy efficient appliance credits for eligible products, and understanding its components is key to successful filing.

Follow the steps to fill out Form 2055 accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Begin by entering your identifying number and the name(s) shown on your return at the top of the form.

- In Part I, line 1, input the total number of eligible dishwashers produced in the calendar year 2010.

- Enter the average number of eligible dishwashers produced in the two prior calendar years on line 2.

- Subtract the amount on line 2 from the amount on line 1 on line 3 to determine the production increase.

- On line 4, input the applicable amount for dishwashers, then multiply the result from line 3 by the value on line 4 on line 5.

- Proceed to Part II and repeat similar steps for clothes washers, starting with the number produced in 2010 on line 6.

- Complete the corresponding fields for previous production averages and applicable amounts in the same manner for clothes washers.

- Continue to Part III, entering the eligible refrigerators produced in 2010 on line 12 and following the same calculation format for past years and applicable amounts.

- In Part IV, sum lines 5, 11, and 17 to find your total energy appliance credit on line 18.

- Follow through the remaining calculations on lines 19 to 27, ensuring all values are entered aptly.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as required.

Complete your documents online with confidence and ensure proper filing of your energy efficient appliance credits.

To file a 1040 for previous years, first gather your income documents and tax forms for those years. You will need to print the appropriate 1040 forms for each tax year from the IRS website. After completing the forms, mail them to the IRS along with any due payments. Additionally, make sure to review information regarding What Is Form 2055 Irs For 2010 to aid in your filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.