Loading

Get 2010 Form 8885

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 8885 online

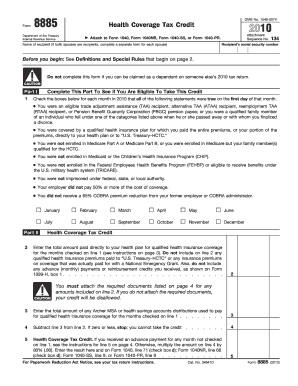

Filling out the 2010 Form 8885 online can be straightforward if you follow the right guidance. This form is used to calculate your eligibility and amount for the health coverage tax credit, providing critical financial support for eligible individuals.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the qualifications for the health coverage tax credit outlined in Part I of the form. Ensure you check the boxes for each month that you satisfied the eligibility criteria as of the first day of each month in 2010.

- In Part II, enter the total amount you paid directly to your health plan for qualified health insurance coverage for the months you checked in Part I. Avoid including amounts paid to ‘U.S. Treasury–HCTC’ or any premiums reimbursed through a National Emergency Grant.

- Provide the total amount from any Archer MSA or health savings account distributions used for the qualified health insurance for those months. Subtract this amount from the total entered in the previous step.

- Multiply the remaining amount by 80% (0.80) to calculate your health coverage tax credit. Ensure to enter this result in the appropriate section of Form 1040 or related forms as instructed.

- Prepare to attach all required documentation to support your claims for the premiums paid. This includes insurance bills, proof of payment, and any other specified documents as listed in the form instructions.

- Review your filled-out form for accuracy. Once confirmed, you can save the changes, download, print, or share the completed form as needed.

Start by accessing the online form to ensure you complete the 2010 Form 8885 accurately.

To get your Affordable Care Act form, check with your health insurance provider or employer for the necessary documentation such as the 1095-A, 1095-B, or 1095-C forms. You can also access these through your online account with your provider. If you have associated tax forms like the 2010 Form 8885, keeping them in mind can help simplify your review of benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.