Loading

Get 8849 Schedule 2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8849 Schedule 2 Form online

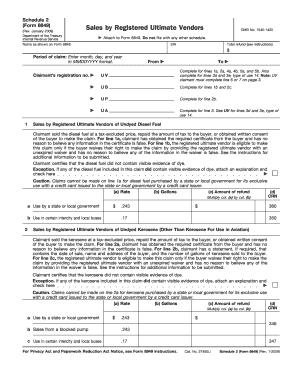

Filling out the 8849 Schedule 2 Form online is an essential process for registered ultimate vendors seeking to claim refunds for specific fuel sales. This guide provides a clear and comprehensive overview of the steps required to complete the form accurately.

Follow the steps to fill out the 8849 Schedule 2 Form correctly.

- Use the ‘Get Form’ button to access the 8849 Schedule 2 Form and open it in your preferred online editor.

- Begin by entering your name as shown on Form 8849 and your Employer Identification Number (EIN) at the top of the form. This identification information is crucial for processing your refund claim.

- In the 'Total refund' section, provide the total amount being claimed in dollars. Ensure that this amount reflects the careful calculations you make based on your sales.

- Indicate the 'Period of claim' using the MMDDYYYY format. This specifies the timeframe during which the sales occurred.

- Fill in your claimant's registration number, which is critical for verifying your eligibility to file this claim.

- Complete the relevant sections for sales by registered ultimate vendors according to the type of fuel sold (undyed diesel, kerosene, gasoline, etc.). Each section will require specific details such as the rate, gallons sold, and the refund amount.

- If applicable, complete the 'Government Unit Information' lines for any government entities to whom fuel was sold. Include taxpayer identification numbers and names along with the gallons sold.

- Review the information entered for accuracy as incorrect information can lead to processing delays or denials.

- Once the form is completed and reviewed, you can save your changes, download the filled form, print it for your records, or share it as needed.

Take the necessary steps today to complete your 8849 Schedule 2 Form online and file your claim.

Failing to include Schedule 2 can lead to inaccuracies in your tax return and potential penalties from the IRS. Without this form, you may overlook reporting additional taxes owed, which could complicate your tax situation. To avoid these issues, ensure you have the 8849 Schedule 2 Form completed and ready with the help of resources like US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.