Loading

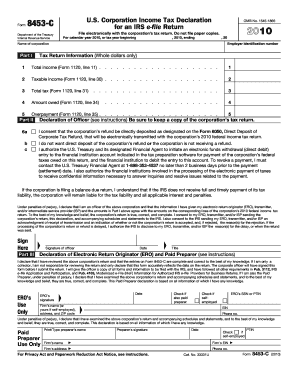

Get 2010 Form 8453-c. U.s. Corporation Income Tax Declaration For An Irs E-file Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 8453-C. U.S. Corporation Income Tax Declaration For An IRS E-file Return online

This guide provides clear and detailed instructions on filling out the 2010 Form 8453-C, which is essential for corporations e-filing their income tax returns. Follow these steps to ensure accurate completion of the form.

Follow the steps to complete your Form 8453-C online

- Click ‘Get Form’ button to access the form and open it in your editor.

- Enter the corporation's name in the provided space. Ensure that you print or type the name clearly.

- Fill in the employer identification number (EIN) in the designated field. This number is crucial for identifying the corporation.

- Move to Part I and provide the total income from Form 1120, line 11, as a whole dollar amount.

- Next, indicate the taxable income from Form 1120, line 30, also as a whole dollar amount.

- Report the total tax calculated from Form 1120, line 31, ensuring accuracy in the amount entered.

- Input the amount owed according to Form 1120, line 34, if applicable.

- Provide details on any overpayment from Form 1120, line 35.

- In Part II, check all applicable boxes under Declaration of Officer. Ensure the officer's consent regarding the direct deposit of any refunds is clearly marked.

- The corporate officer must sign and date the form. It’s essential that the officer is authorized to sign the corporation’s federal income tax return.

- If a paid preparer or Electronic Return Originator (ERO) is involved, complete Part III as required, ensuring all signatures are acquired.

- Once the form is fully completed, save changes, download, and print a copy for your records before submitting it with the electronic return.

Complete your documents online for a smooth filing experience.

To obtain a signed copy of your tax return, you may need to access your records through the electronic filing service you used. If you filed using the 2010 Form 8453-C, U.S. Corporation Income Tax Declaration For An IRS E-file Return, ensure you keep a copy in your records. Additionally, you can request a transcript directly from the IRS for past returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.