Loading

Get Form 4029

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4029 online

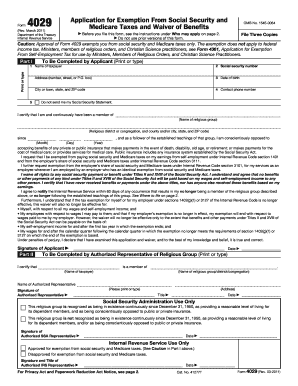

This guide provides a comprehensive overview to assist you in completing the Form 4029 online. Understanding the components of this form is crucial for those seeking exemption from social security and Medicare taxes.

Follow the steps to fill out Form 4029 efficiently.

- Click the ‘Get Form’ button to access the form and open it in your chosen application.

- Begin with Part I by entering your name in the first field. Ensure that you use an accurate and legible format.

- Enter your social security number in the designated field. If you do not have one, you will need to apply for it using Form SS-5.

- Provide your address, including the street number, city, state, and ZIP code.

- Fill in your date of birth to confirm your identity.

- Input your contact phone number for any necessary follow-up.

- If you do not wish to receive a Social Security Statement, indicate your preference in the checkbox provided.

- State the name of your religious group and the relevant religious district or congregation, including the date you became a member.

- Certify your opposition to public or private insurance by acknowledging your understanding of the various benefits and waivers outlined in the form.

- Sign and date the form in the area designated for the applicant’s signature.

- In Part II, if applicable, have an authorized representative from your religious group complete their section by providing their name, title, signature, and date.

- Save your changes, and download or print the completed form. Ensure you keep copies for your records.

Start your application process and fill out Form 4029 online today.

When addressing the foreign earned income exclusion on Form 4029, provide clear and concise information about your income and residency. Use the form's guidelines to explain how you meet the requirements for claiming the exclusion. Being thorough will enhance your chances of a smooth review process with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.