Get Completed Irs Form 1023 Rev June 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Completed Irs Form 1023 Rev June 2009 online

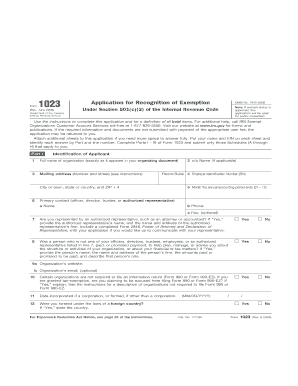

Filling out the Completed Irs Form 1023 is an important step for organizations seeking recognition of exemption under section 501(c)(3) of the Internal Revenue Code. This guide offers a clear, step-by-step approach to help you complete the form online effectively and efficiently.

Follow the steps to complete the form online successfully.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Begin with Part I, Identification of Applicant. Enter the full name of your organization exactly as it appears in your organizing document and provide the mailing address, including the room or suite number and ZIP code.

- In Part II, Organizational Structure, check the appropriate box to indicate your entity type, whether a corporation, unincorporated association, or trust. Attach required documents supporting your organizational structure.

- Proceed to Part III, Required Provisions in Your Organizing Document. Confirm that your organizing document states your exempt purpose and include specifics as required.

- For Part IV, Narrative Description of Your Activities, provide a detailed explanation of your organization’s past, present, and planned activities. This narrative is essential and should be thorough.

- Complete Part IX, Financial Data, based on the duration of your organization’s existence. Provide financial information for the required number of tax years, including projections as necessary.

- In Part X, Public Charity Status, follow the updated instructions carefully, especially regarding the completion of lines related to the years in existence.

- Move to Part XI, User Fee Information, and select the appropriate user fee according to your organization’s gross receipts. Make sure to include the payment with your application.

- Review all filled parts, ensuring you have checked the necessary schedules applicable to your organization, such as Schedule A through H.

- Finalize your application by saving changes, downloading, and preparing to print or share the completed form. Follow the submission guidelines provided.

Proceed with your application by completing the form online today!

A 1023 document refers to the Completed Irs Form 1023 Rev June 2009, which is an application to the IRS for tax-exempt status. This document contains essential information about your organization, including its structure, purpose, and activities. It serves as the formal request that outlines how your organization meets the requirements for exemption under federal law. Understanding and accurately completing this form is crucial for your organization’s compliance and operational success.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.