Loading

Get Fillable Pdf 2010 Form 709

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Pdf 2010 Form 709 online

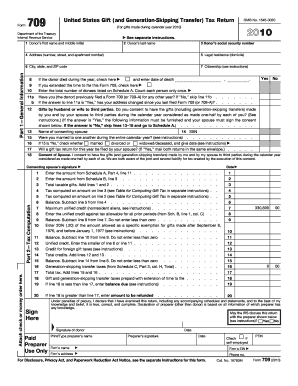

Filling out the Fillable Pdf 2010 Form 709 is essential for reporting gifts made during the calendar year 2010. This guide provides clear, step-by-step instructions to help users complete the form online accurately and efficiently.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part 1—General Information. Fill out the donor's first name, middle initial, last name, and social security number. Enter the donor's address, legal residence, city, state, and ZIP code. Indicate the donor's citizenship status and check if the donor passed away during the year.

- Provide information regarding any previous filings of Form 709 or 709-A. If applicable, indicate if there have been changes in the donor's address.

- If applicable, consent to split gifts with the spouse by indicating their name and providing necessary details if gifts to third parties are to be considered as made jointly.

- Fill out Part 2—Tax Computation by entering the total number of donees and checking if an extension for filing was granted.

- Complete all necessary calculations regarding taxable gifts, including any amounts from Schedule A, B, and C, based on previous years or generation-skipping transfer taxes, as applicable.

- In the signatures section, verify and input the donor’s signature and any preparer's details as required, ensuring all statements are true and correct under penalties of perjury.

- Finally, review all entries for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your documents online with confidence and ensure timely submission.

You can file tax returns separately, which is especially useful for married couples who prefer this approach. Filing separately allows each person to report their own income and deductions. However, it’s vital to weigh the implications this choice may have on your overall tax liability. Using resources like the fillable PDF 2010 Form 709 can help you navigate this easily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.